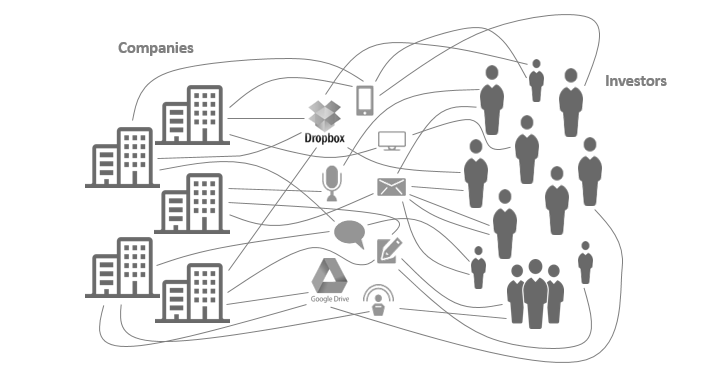

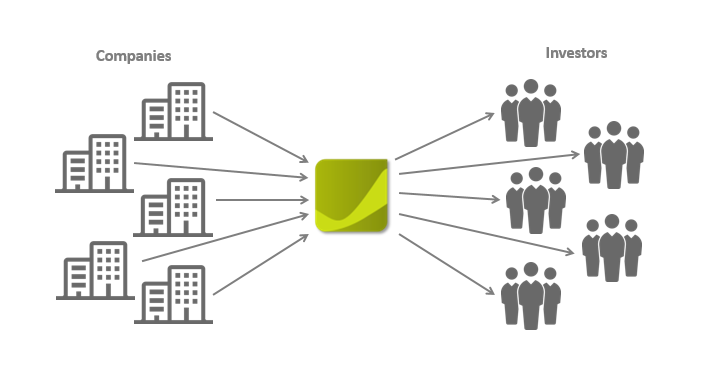

COMPANIES GIVING ACCESS TO INFORMATION

Companies easily upload corporate information, privately and securely control the access to it by their investors, shareholders, brokers and others stakeholders.

MANAGERS ANALYSE THE INFORMATION

Managers receive this information automatically, and can generate graphs, reports, and analytical tools, allowing them to easily evaluate their investment portfolio.

INVESTORS AND LPS ACCESS THE REPORTS

Investors and LPs receive documents and information from these managers and companies, through reports or the corporate website, with simplicity, practicality, and convenience.

There is an optional tool to easily and safely identify liquidity opportunities, respecting private contracts and shareholders’ agreements.